Luxury tax for House in kerala

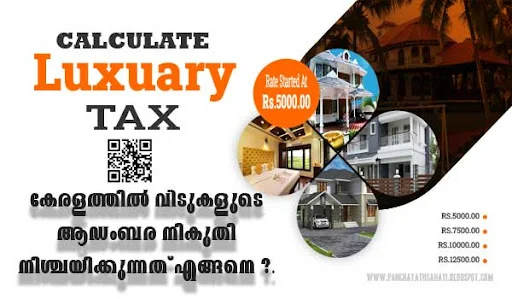

How is luxury tax calculated in Kerala for House?

One time building tax is applicable for all buildings constructed on or after April 1, 1973 as per the Kerala Building Tax Act, 1975. A yearly luxury tax of Rs. 4000 is levied on buildings which are constructed on or after 1.4. 1997 having a plinth area of 278.7 sqm or more, in addition to the one-time tax.

Revised Rate of Luxury Tax

As per Kerala Finance Act, 2020, the one-time building tax and luxury tax on domestic and non-domestic buildings in the State has been revised with effect from 01.04.2020.

| SL. No. | Plinth Area | Tax Amount (Rs:) |

|---|---|---|

| 1 | Not exceeding 278.7 Square Metres | Nil |

| 2 | Above 278.7 Square Metres but not exceeding 464.50 Square Metres | 5000.00 |

| 3 | Above 464.50 Square Metres but not exceeding 696.75 Square Metres | 7500.00 |

| 4 | Above 696.75 Square Metres but not exceeding 929 Square Metres | 10000.00 |

| 5 | Exceeding 929 Square Metres | 12500.00 |

കെട്ടിടങ്ങളുടെ ആഡംബര നികുതി കണക്കാക്കുന്നതിന് ഇവിടെ ക്ലിക്ക് ചെയ്യുക

Those who pay luxury tax together for 5 years or more will be given a 20% rebate on the total tax.

In the case of flats / apartments, each apartment / flat should be treated as a separate unit for the purpose of luxury tax after the building is handed over by the builder.

As long as the building owner owns the building or some of its parts, the area should be treated as a single unit and considered for building tax. Thus luxury tax should be levied on building parts subject to Section 5A of the Building Tax Act, 1975. For example, if a person buys 3 flats, he has to pay luxury tax based on the total plinth area. (SC3 / 121/2018 / Revenue No. Order dated 30.01.19)

The Assessing Authority should ascertain whether each apartment and building can be used independently when determining the luxury tax on apartment complexes or buildings after the sale or transfer of the flat / apartment.

The tax should be calculated on the area of commonly used building components (stair case, generator room, veranda, elevator, security area, etc.) and its fixed ratio to the area of each apartment / flat. (Circular No: 78994 / SC1 / 2015 / Revenue Date. 18.01.2017)

Click here to calculate the luxury tax

Tax payment:-Building tax can be paid at the Village Office in installments as specified in the tax assessment order. The taxpayer can pay the full amount in one lump sum if required. Failure to pay the building tax or luxury tax by the due date will result in the payment of 6% interest per annum from the date of default (Section 19). If any building owner proves that the tax he paid is more than the prescribed tax, he is entitled to an additional tax refund. The amount is to be refunded by the tax assessment authority.

Certificate of payment of tax:-At the request of the building owner who has paid the full amount of the prescribed tax, the Assessor shall issue a certificate in Form No.8. Buildings that are exempt from paying building tax, if required by the owner, must also provide a certificate on Form 9.

**Validation Notwithstanding anything contained in the Kerala Building Tax Act, 1975 (7 of 1975) any tax collected or paid under section 5, at the rate specified in Schedule I of the said Act, at such higher rates, by virtue of the provisions of the Kerala Finance Bill,2020 (Bill No.257 of XIV Kerala Legislative Assembly) in respect of the period with effect from 1st day of April, 2020 to 10lh September 2020 shall be deemed to have been validly collected or paid and the tax so collected shall not be refunded

No comments

Attention please!

« Dont comment anonymously! It wil be autornatically detected as spam so your comment wont published.Just select Name/Url if you want leave link of your site

« Don't put link of your site in comment body

« Keep polite to speak